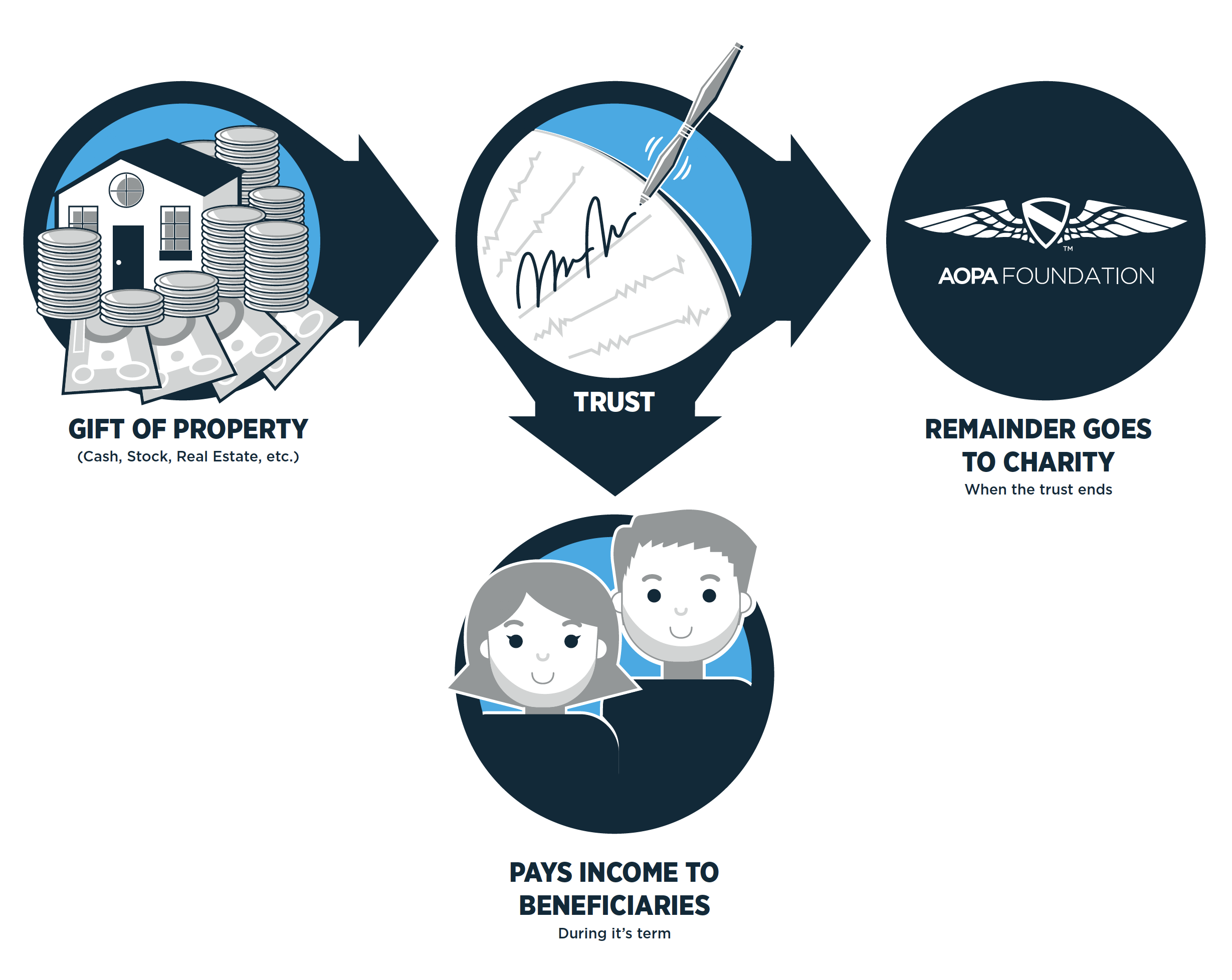

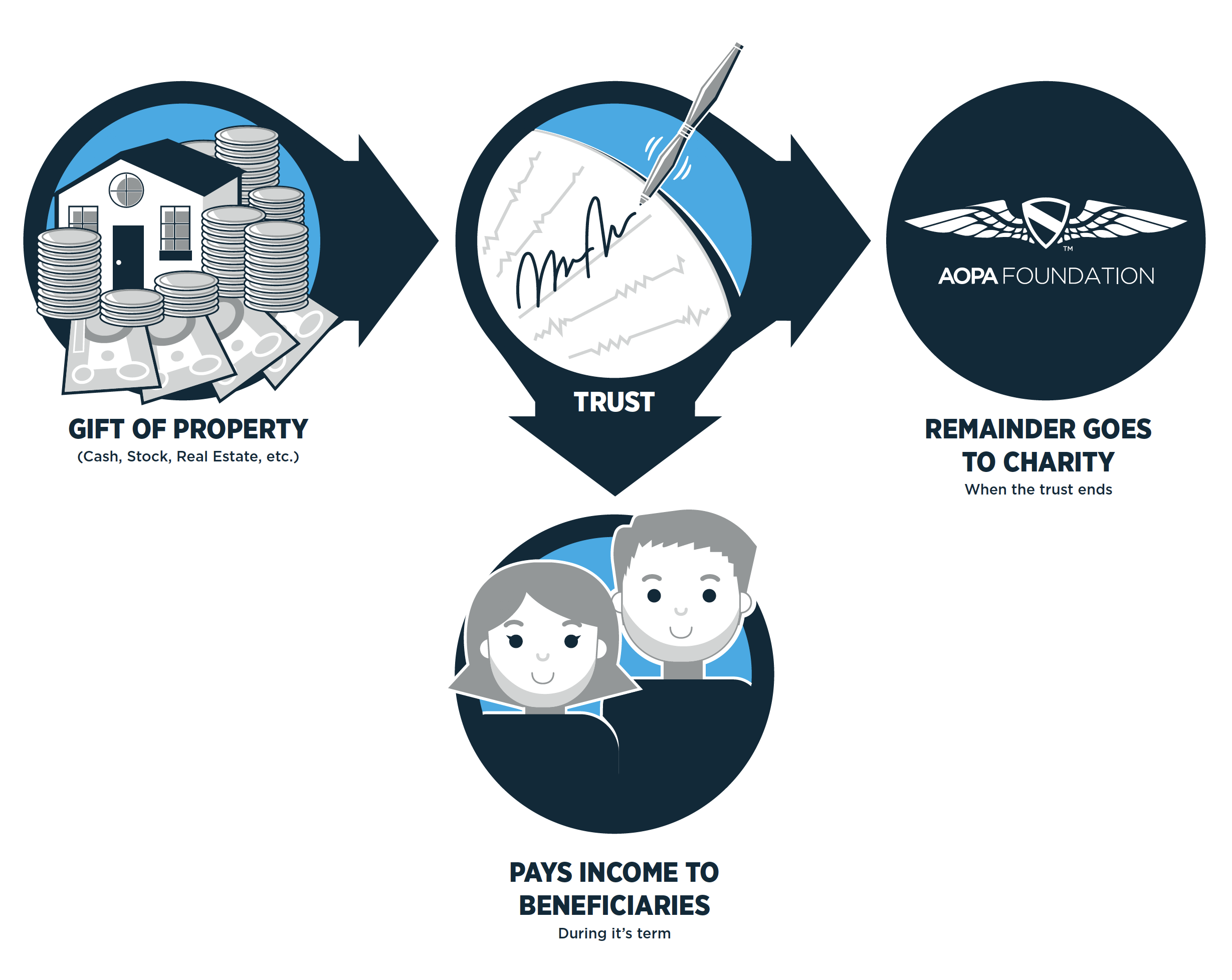

A charitable remainder trust allows you to provide an income for yourself or someone else, while also supporting the work of AOPA. The assets (cash, stocks, bonds, real estate, etc) that you contribute to the trust are held and invested and the beneficiaries receive income from the trust during its term.

The trust provides you with an immediate income tax deduction and you avoid capital gains taxes if appreciated assets are used to fund the trust. When the trust ends, the remaining funds go to support the charity(ies) you have designated.

Trusts are flexible and can offer many benefits to you and your family.

This information is not intended as legal or financial advice. Because every situation is different, we recommend contacting your attorney or tax advisor to see if this type of gift is right for you.

Please click here to notify us of your intentions to include the AOPA Foundation in your charitable remainder trust.

If you would like more information on including making the AOPA Foundation in your charitable remainder, please complete and submit the form on this page, or contact our Legacy Giving office at 301.695.2320 or [email protected].